Click on Permohonan or Application depending on your chosen language. The 597 percent marginal rate on income between 21400 and 80650 was eliminated.

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

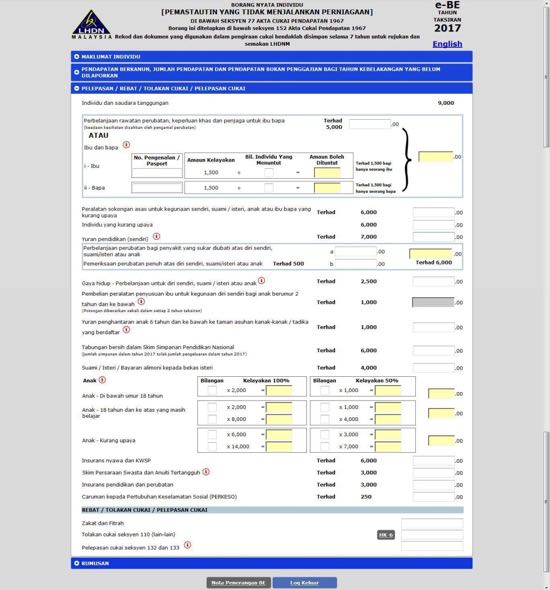

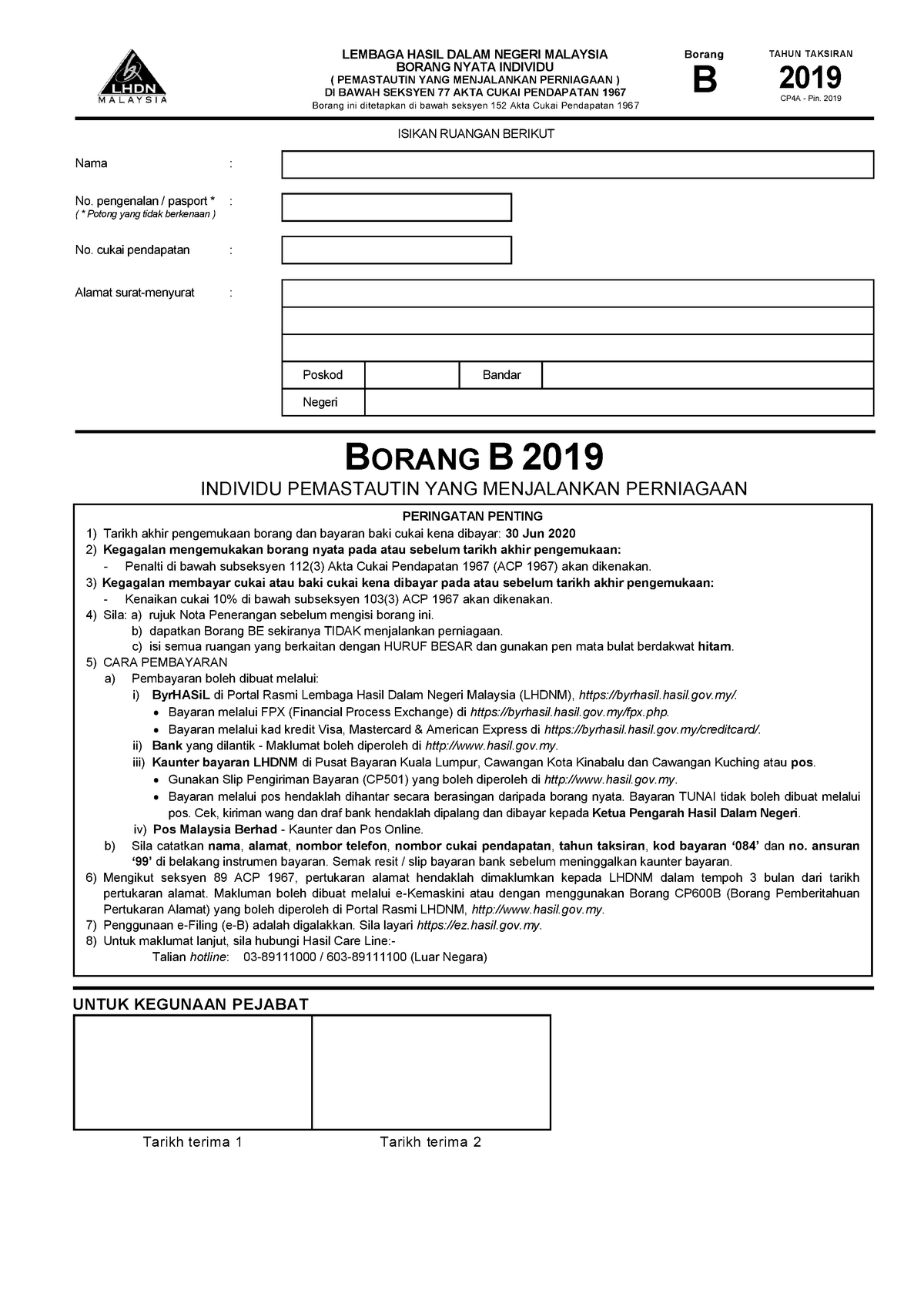

Pembayar cukai boleh mengemukakan Borang Nyata Cukai Pendapatan BNCP tahun taksiran semasa mereka melalui e-Filing bagi borang E BE B BT PM MT dan TF.

. Click on e-Filing PIN Number Application on the left and then click on Form CP55D. Income Tax Malaysia 2022 Basic Guide For Beginners. Watch This Before Filing Income Tax 2022 pt1 Complete Guide To File Tax Returns In Malaysia.

Kalau nak senang bayar pada firma akauntan untuk mereka bantu buat semua termasuk isi borang nyata cukai pendapatan. 4 Self whose spouse has no income no source of income or has tax exempt income 5 Self Single divorcee widow widower deceased A8a Entitled to claim incentive under section 127 Indicate X 1 Paragraph 1273b 2 Subsection 1273A 3 Not relevant. Sehubungan itu keseluruhan rangkaian sistem LHDNM meliputi EzHasil Bantuan Sara Hidup dan Bantuan Prihatin Nasional akan ditutup bagi tujuan penyelenggaran seperti berikut.

A rujuk Nota Penerangan sebelum mengisi borang ini. Guide To E Filing Income Tax Malaysia Lhdn. 2003STTS Female SAMPLE TAHUN TAKSIRAN.

Alamat Address Bandar Town Poskod Postcode Negeri State. 1101 4th Street SW Suite 270 West Washington DC 20024. Buku panduan borang b 1.

Skrin borang e-BE akan dipaparkan. Tersalah Isi Borang E Filing - Cara Isi E Filing 2022 Panduan Lengkap Claim Income Tax Borang Be Semakan Malaysia - What chocolate candy starts with the letter. C isi semua ruangan yang berkaitan dengan HURUF BESAR dan gunakan pen mata bulat berdakwat hitam.

Income tax return for individual who only received employment income. Choose your corresponding income tax form ie. Once youve logged in under the e-filing section click on e-Borang and that will take you to your tax e-filing form.

Pembayaran balik cukai terlebih bayar pula dilakukan dalam tempoh dua 2 minggu setelah tarikh penghantaran. Download a copy of the form and fill in your details. Those earning between 13900 and 215400 are subject to marginal tax decreases as the corresponding rates decreased from 59 percent and 633 percent to 585 percent and 625 percent respectively.

Pada skrin e-Borang pilih jenis borang dan klik tahun taksiran yang berkaitan. Tarikh akhir hantar borang e-Filling cukai pendapatan untuk taksiran tahun 2021 boleh dirujuk pada maklumat Tarikh Akhir Hantar e-filling 2022. Sayangwang pindaan efiling lhdn borang cukai be b.

Monday to Friday 9 am to 4 pm except District holidays. Go back to the previous page and click on Next. Income Tax File No.

What would be the action taken by IRBM when the income declared in the Form B is lower compared to the income after tax audit. B dapatkan Borang BE sekiranya TIDAK menjalankan perniagaan. IRBM will raise an Additional Assessment JA together with a penalty under subsection 1132 of the ITA 1967.

Employers Income Tax File No. The amount of increase in tax charged for an Amended Return Form furnished within a period of 6 months after the date specified in subsection 771 of ITA 1967 shall be 10 of the amount of such tax payable or additional tax payable as shown in the following formula-. 30062022 15072022 for e-filing 6.

Meanwhile if you did not register your business then use the usual BE form for those with non-business income to file your tax as a freelancer instead. 5 CARA PEMBAYARAN a. Office of Tax and Revenue.

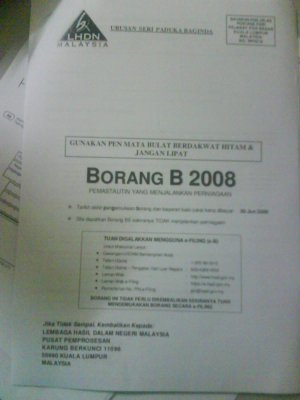

Panduan Lengkap Cara Isi E-Filing Cukai Pendapatan Individu Borang BEB 2021. Purchase of basic supporting equipment for disabled self spouse child or parent. Ask the Chief Financial Officer.

Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner 8000 Restricted 3. E-BE if you dont have business income and choose the assessment year tahun taksiran 2015. Individual and dependent relatives.

很多年轻人踏入社会后对报税 Income Tax 这两个字懵懵懂懂. IRB Branch-E-PART TAXPAYERS PERSONAL PARTICULARS REFER NOTE SELF Male Borang yang ditetapkan di bawah Seksyen 152 Akta Cukai Pendapatan 1967 Form prescribed under Section 152 of the Income Tax Act 1967 CP 4 - Pin. Tax-Buku Panduan Mengisi Borang B 2013.

请问我要怎么知道我已经Register Income Tax 呢 我有收到cukai pendapatan的来信但是我要在login的时候却忘记密码当我按Forgot Password再输入我的IC号码却显示Digital Certificate does not exist所以代表说我没有注册过吗. Sebelum mengisi borang e-Filing pengguna. Completed should be submitted to the IRBM branch handling your income tax file.

BORANG PERFOMA B PENGHIBUR AWAM YANG TIDAK BERMASTAUTIN NON-RESIDENT PUBLIC ENTERTAINER PEMBERITAHUAN DI BAWAH SEKSYEN 109A. Klik pautan e-Borang di bawah menu e-Filing. The tax or additional tax payable is subject to an increase in tax under subsection 77B4 of ITA 1967.

Your bracket depends on your taxable income. 30042022 15052022 for e-filing 5. There are seven federal tax brackets for the 2021 tax year.

Income tax return for partnership. Sistem ezHASiL akan memaparkan skrin eBorang seperti di bawah. In this form you will be able to declare your side income under Statutory income from interest discounts royalties pensions annuities other periodical payments and other gains and.

Income Tax E Filing For Malaysians step By Step 2022 Guide. 02 April 2020 Khamis hingga 03 April 2020 Jumaat. 5 Tips For Sole Proprietors In Malaysia Lhdn Borang B Tax Filing.

Income tax return for individual with business income income other than employment income Deadline. Borang e-Filing boleh mula dilengkapkan mulai 1 haribulan Mac setiap tahun dan tarikh akhir adalah pada 30 April. Maklumat pada borang terbahagi kepada 4 bahagian iaitu.

Lembaga Hasil Dalam Negeri Malaysia HASiL ingin memberikan peringatan kepada semua pembayar cukai yang tidak menjalankan perniagaan agar segera melaporkan pendapatan mereka yang layak. CUKAI PENDAPATAN ORANG PERSEORANGAN PEMASTAUTIN YANG MENJALANKAN PERNIAGAAN. LAPORKAN PENDAPATAN TAHUN TAKSIRAN 2021 SELEWAT-LEWATNYA PADA 15 MEI 2022 DAN ELAK PENALTI LEWAT KEMUKA BORANG NYATA CUKAI.

700 malam hingga 700 pagi. 10 12 22 24 32 35 and 37.

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Cara Isi Borang Ea Form Otosection

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Form Be For Reference Only Pdf Lembaga Hasil Dalam Negeri Malaysia Return Form Of An Individual Resident Who Does Not Carry Business Under Section Course Hero

How To Step By Step Income Tax E Filing Guide Imoney

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

My First Time With Income Tax E Filing For Lhdn Namran Hussin

How To File For Income Tax Online Auto Calculate For You

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

Borang B 2019 1 Tax Borang B 2019 Individu Pemastautin Yang Menjalankan Perniagaan Tarikh Terima Studocu

Income Tax Cukai Pendapatan Your Tax We Care

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About